Large companies usually employ more than 250 people and have to consider their environmental impact differently to small and medium enterprises (SMEs). SMEs represent 99% of all businesses in the EU and in all countries between 70% and 95% of all firms are micro-enterprises, i.e. firms with less than ten persons employed. Large companies however bring in more revenues and have bigger impacts on nature and it’s economic value.

Public health risk of greenwashing

Large enterprises need to take the environment into account and the public health effects thereof. To make ‘light work’ of this is considered greenwashing as sustainability requires consideration and not only imagination.

Insurance companies can try to quantify public risks of technology but exceeding air emissions license limits is what often occurs in areas where the air pollution is high and produced by large companies. The risk of biodiversity loss can increase with particulate matter and Carbon emissions left in the air where large operations are underway.

Large operations could help SMEs get more business growth by sharing in the decarbonisation plans of larger companies to avoid greenwashing. As McKinsey correctly found, “decarbonization programs allow companies to realize cost savings relatively quickly.” However the up-front required investment cost and skills required may “hinder SMEs from pursuing them.” In a broader assessment, BloombergNEF found that 44% of energy loans went to low-carbon energy supply projects.

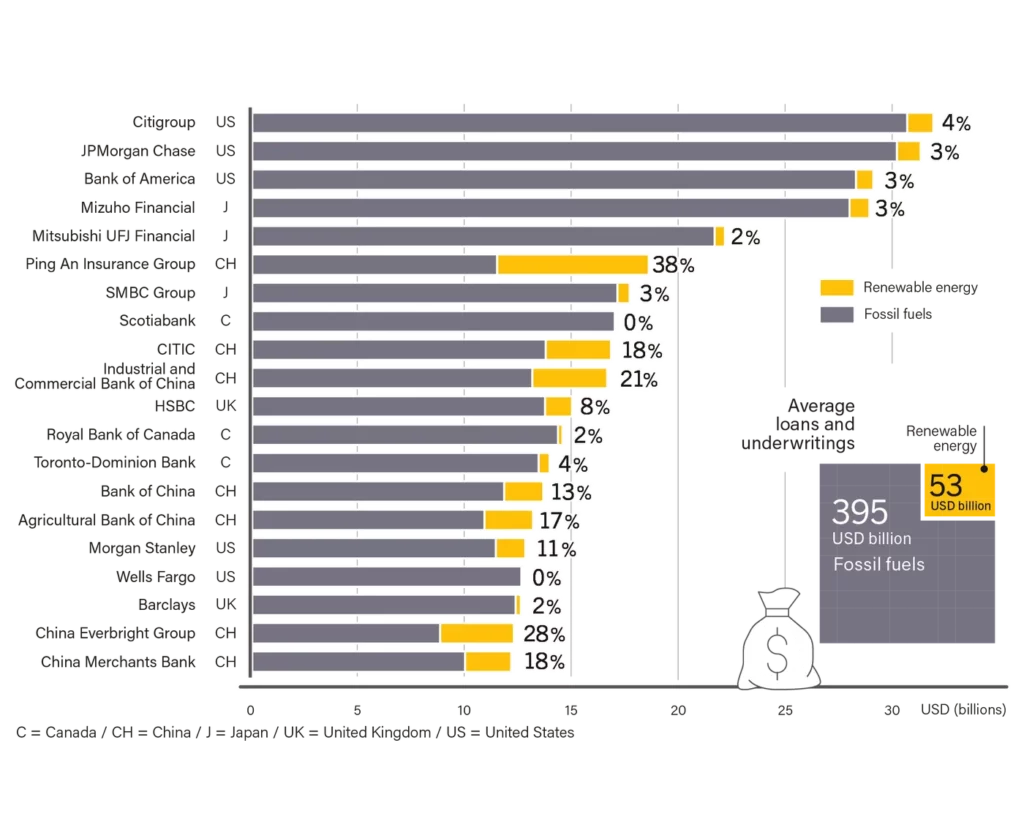

“By country of origin, Chinese banks are the biggest renewable energy funders, providing USD 51 billion in 2021 and 2022, but this was still only 22% of total energy finance in the country. US institutions are the second largest source of energy finance and provided USD 6 billion in 2021 and 2022 for renewable energy, accounting for only 4% of total national energy finance. Among the top 20 home countries of investors, other than China, only institutions in Switzerland, Italy, Norway and Australia dedicated more than 10% of their energy finance to renewables.” – REN21

Role of Public Benefit Organisations

Four of Britain’s biggest Nature charities have joined the fight against greenwashing in 2023. The Wildlife Trusts, the RSPB, the Woodland Trust and the National Trust have jointly published Nature Markets Principles, which they believe will combat a ‘lack of regulation’ for the emerging Nature markets.

‘Everyone involved in Nature conservation is alive to the risk of greenwash,’ says Alistair Maltby, director of estate and woodland outreach at the Woodland Trust. Hence the voluntary principles have been developed with Finance Earth and Federated Hermes, which manage the Government-backed UK Nature Impact Fund.

Verifiability is a key issue, and it has been reported by Country Life that many large Nature-based credit schemes have proven to be misleading. In January, The Guardian also reported that at least 90% of the forest carbon offsets used by large companies such as Shell, Disney, Gucci and others “do not represent genuine carbon reductions.”

The rise of 3rd party service providers might come to mind, but the greenwashing risk is mostly in the project itself. For example, the activity of moving to an Electric Vehicle (EV) that uses renewable energy or just moving pure EV instead of hybrid. Another example is intergenerational effects such as electric school buses for children or incentives for students who are climate aware.

Role of fossil fuel companies

Energy Attribute Certificates: Energy supply of fuels has often gone along with energy attributed to the product. These certificates similar to a Material Safety Data Sheet, describe the energy attributes of the fuel or oil associated with the transaction or pipeline or barrel. Today the negative effects of Carbon in the same fuel, are accounted for as a separate carbon offset certificate, and this has grown to steel markets, cement, forestry and more – to describe the inherent greenhouse gases that put nature at risk of global warming by over 1.5 degrees.

The polluter pays principle could be easily solved, if the traders and creators of the fuels, offset their emissions using carbon offset certificates. However high quality carbon credits need to include Just Transition elements which means the supply chain lifecycle being relieved of further emissions and biodiversity considerations automatically makes additionality a possibility. As Rob Stoneman says, “Nature-based credit schemes present a real opportunity to restore Nature and create regeneration and prosperity in the countryside — if done in the right way.”

Rebranding of fossil fuels: “Fossil fuel companies are increasingly rebranding as “energy companies”, as awareness about climate change grows and societal acceptance of fossil fuel use plummets. At the same time, some governments have shifted their political priorities in a push to phase out oil and gas production, although fossil fuels remain heavily subsidised.” -REN21

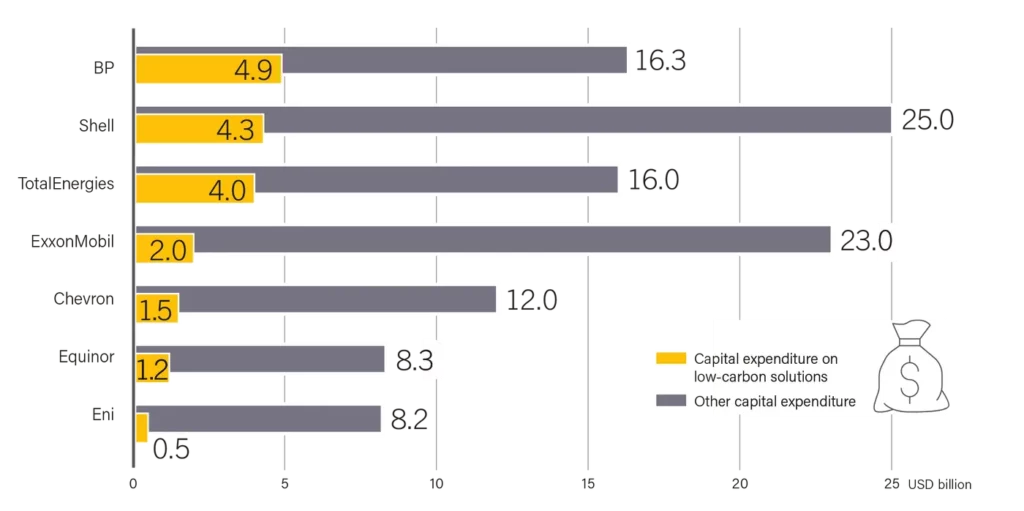

Large company capital flows: “In 2022, in the context of the global energy crisis, the five biggest western fossil fuel companies – Chevron, ExxonMobil, Shell, BP and TotalEnergies – earned their highest profits ever, totalling USD 195 billion, or 120% more than in 2021. Despite widespread commitments towards net zero emissions by 2050, as of 2022 low-carbon solutions averaged only 17% of the total capital investment of the top seven fossil fuel companies.” -REN21

Conclusion

These new greenwashing risks from new climate friendly business models creates a new environment of inclusive capitalism with new perceived risks.

Finance for green capital for Global South companies is low but large companies can promote a Just Transition carbon aware economy.

Share this article